The Path to Forex Success

Embarking on a journey in Forex trading requires more than just financial intuition; it demands strategic planning and a realistic mindset. As an experienced analyst at MarkUP Trade, I’m here to guide you through the essential steps to set and achieve realistic trading goals.

Topics

Understanding the Importance of Forex Trading Goals

Setting Goals for Different Trading Levels

Strategies to Achieve Your Trading Goals

Understanding the Importance of Forex Trading Goals

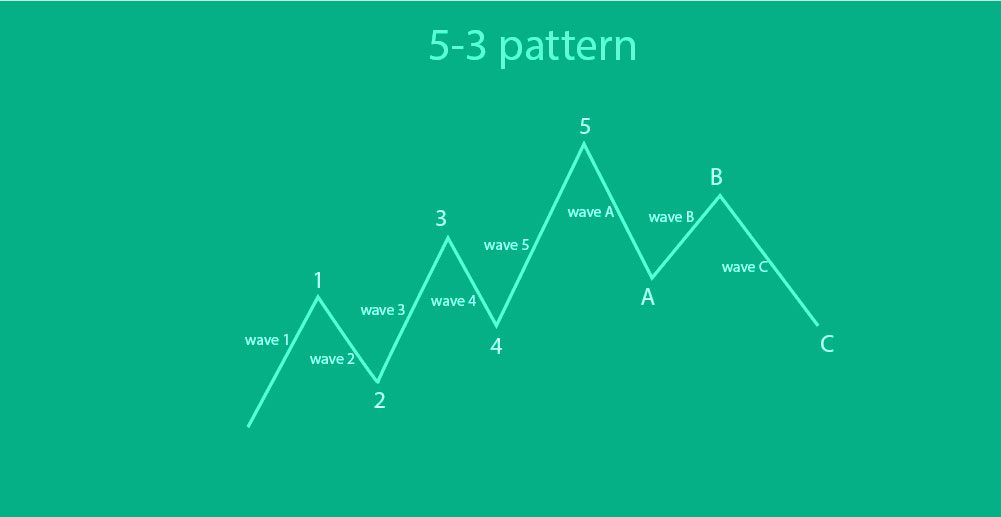

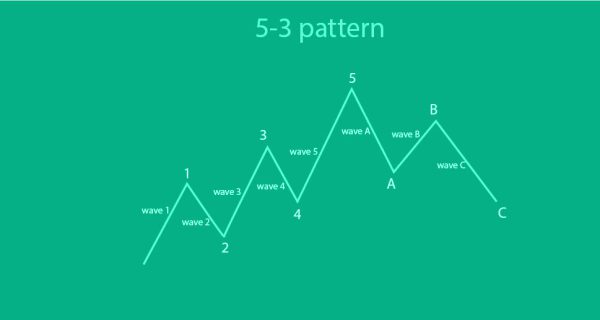

Forex, being the dynamic market that it is, often attracts traders with unrealistic expectations. Some view it as a quick gamble, neglecting the complexity that lies beneath successful trading. To navigate this intricate landscape, envision your journey as a staircase. Your ultimate success is at the top, and each step represents a trading goal, a milestone toward proficiency.

Setting Goals for Different Trading Levels

For beginners, the initial focus should be on mastering the basics – learning market intricacies, risk management, and honing analytical skills. As you progress, emphasis shifts to realistic profit targets, portfolio growth, and strategic trading plans. MarkUP Trade recognizes these distinct phases and tailors guidance accordingly.

Strategies to Achieve Your Trading Goals

- Learning the Trading Basics: Start by immersing yourself in the fundamentals. Online resources, including courses by MarkUP Trade, provide valuable insights. Knowledge is the foundation; embrace it.

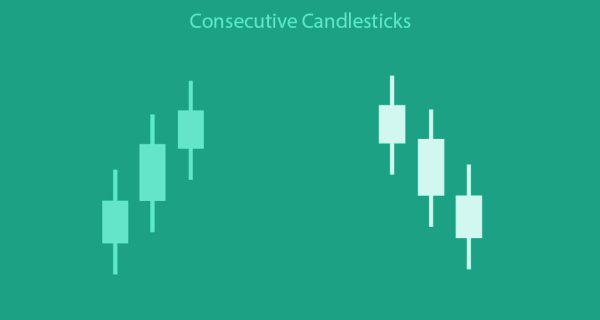

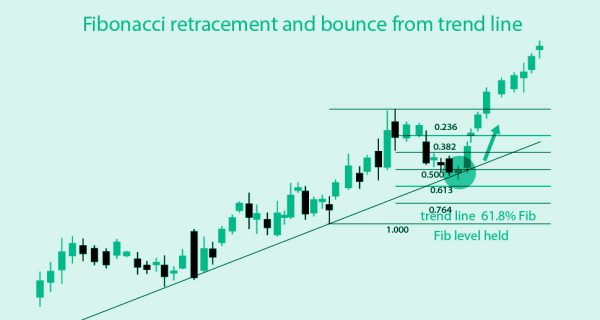

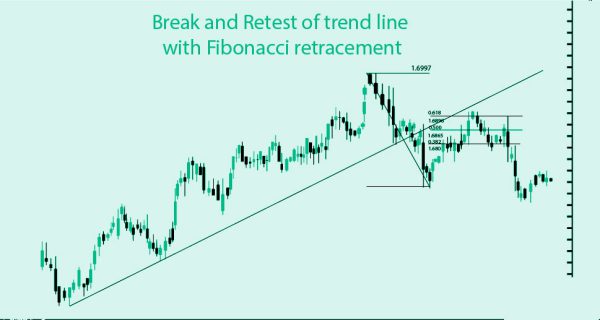

- Using Trading Tools: Equip yourself with technical indicators and tools. Understanding their functions aids in identifying entry and exit points, empowering you to react swiftly to market changes.

- Tracking Wins and Losses: Regularly assess your trading performance. Analyzing past trades reveals strengths and weaknesses, offering opportunities for improvement. Progress breeds confidence.

- Building Risk Management Strategies: Mitigate losses through prudent risk management. Utilize tools like stop-loss orders and trade an amount you can afford to lose. MarkUP Trade emphasizes the significance of safeguarding your capital.

- Setting Realistic Profit Targets: Opt for steady, achievable profit targets over lofty aspirations. Consistent, smaller profits are more sustainable and contribute to long-term success.

- Making a Trading Plan: Craft a comprehensive trading plan encompassing goals, strategies, risk management, and more. It serves as your roadmap, keeping you focused and disciplined.

- Diversifying Your Portfolio: Minimize risk by diversifying your asset portfolio. MarkUP Trade recommends exploring currency pairs with low correlation to enhance risk management.

MarkUP Trade Analyst Jonathan Bennett advises: ‘Realistic goals are the bedrock of Forex success. Stay motivated, learn from each step, and grow as a trader.’ Embrace the journey, and success will follow.