Trendlines and Price Channels in Forex Analysis

Trendlines and Price Channels in Forex Analysis

Traders in the forex market often emphasize that “riding the trend” is a profitable strategy, as market trends offer consistent opportunities to gain pips. During periods of upward or downward market movement, trend lines and channels emerge as dependable tools for technical analysis.

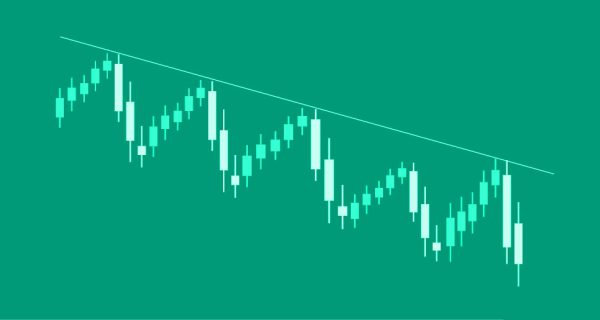

Trend lines are established by connecting recent price highs or lows. In particular, an uptrend line (ascending) is formed by linking recent lows with a straight line. Conversely, a downtrend line (descending) is formed by connecting recent highs with a straight line.

Ascending trend lines often provide a supportive base for price movements during ongoing uptrends. When buying momentum remains strong, price tends to retrace to this rising support level and bounce. The emergence of new highs further confirms the continuation of the uptrend.

Conversely, descending trend lines serve as resistance zones for price action in robust downtrends. If selling pressure remains robust, price tends to retrace to this falling resistance level and rebound. The formation of new lows reinforces the likelihood of the ongoing downtrend.

Similar to other pivotal points, a breach above the resistance of a descending trend line can signal the end of a downtrend and a possible reversal. Conversely, a breach below the support of an ascending trend line suggests an impending shift in the uptrend.

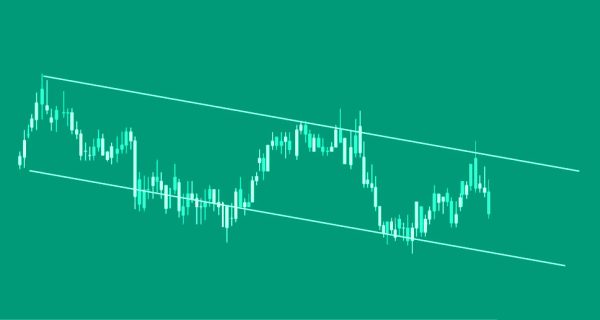

Channels are essentially parallel trend lines. An ascending channel forms when a rising trend line connecting recent lows parallels another trend line linking the latest highs. A descending trend channel takes shape when a trend line connecting recent highs is paralleled by a downtrend line linking the latest lows

Mastering Trading Channels

Channels present robust trading signals, often offering potential take-profit levels. Those who follow market trends can align their trades with the overall market direction. For instance, they might short at the upper boundary of a descending channel or go long at the lower boundary of an ascending channel.

Conversely, countertrend traders take positions contrary to the channel’s direction. This could mean going long at the lower edge of a falling channel or shorting at the upper edge of a rising channel. It’s worth noting that countertrend trades typically carry more risk, whereas trend-following strategies tend to offer higher win probabilities. Many traders seek confluence, where multiple inflection points align, to confirm countertrend setups before taking action.