Irina’s Forex Journey: From $2,100 to $8,420 in Two Years

Meet Irina, a determined trader from the bustling city of Singapore. Two years ago, she ventured into the world of Forex trading with just $2,100 in her savings account. Irina’s journey wasn’t a miraculous rise to wealth but a realistic tale of persistence, learning, and steady growth.

Topics

The Early Days of Curiosity and Learning

Education and Practice: The Turning Point

The Psychological Challenge

Risk Management: Learning the Hard Way

Understanding Margin and Lot Calculation

The Path to Success

Continuous Learning and Growth

The Early Days of Curiosity and Learning

Irina’s journey began with simple curiosity about the financial world. She wasn’t a financial expert or a mathematical genius. She was just an average person eager to understand how to make money in the Forex market.

Education and Practice: The Turning Point

Irina soon realized that if she wanted to succeed in Forex trading, she needed education and practice. She didn’t jump into live trading right away. Instead, she spent several months studying the basics, reading Forex books, and following online tutorials. She opened a demo account to practice her skills, making virtual trades without risking her real capital.

The Psychological Challenge

In the early stages, Irina faced emotional ups and downs. The Forex market was volatile, and the pressure could be overwhelming. There were times when she questioned her decisions, but her determination to succeed kept her moving forward.

Risk Management: Learning the Hard Way

Irina’s first live trades taught her the value of risk management the hard way. She experienced losses, but instead of discouraging her, they motivated her to master the art of protecting her capital. She started using stop-loss and take-profit orders to minimize losses and lock in profits.

Understanding Margin and Lot Calculation

One of the turning points in Irina’s journey was when she grasped the importance of margin and lot size. She learned about risk management from MarkUP Trade‘s expert resources and implemented this knowledge to make more informed decisions. This understanding significantly reduced her exposure to risk.

The Path to Success

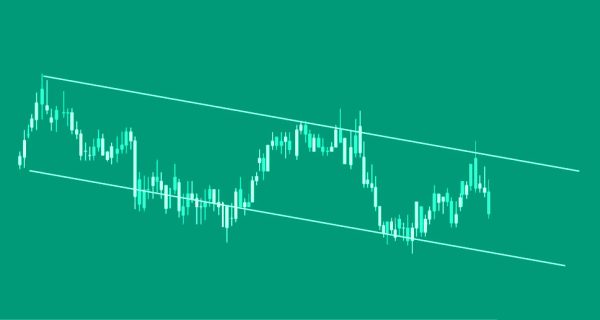

Through patience and discipline, Irina slowly improved her trading skills. She didn’t rush into trades but took calculated steps, even if it meant smaller profits. Her strategy became more refined, and she consistently applied what she had learned.

Continuous Learning and Growth

Today, Irina’s trading account stands at $8,420, an impressive increase from her initial $2,100. Her journey isn’t over; she continues to learn and adapt to market changes. Irina’s story proves that success in Forex trading is achievable for anyone willing to learn, practice, and manage risks.

Irina’s path to success in Forex trading is a realistic one, demonstrating that steady growth is more attainable than rapid wealth. You can follow in her footsteps and begin your journey toward financial independence with MarkUP Trade as your trusted partner.