Foundations of Forex Chart Formations

Mastering Chart Formations

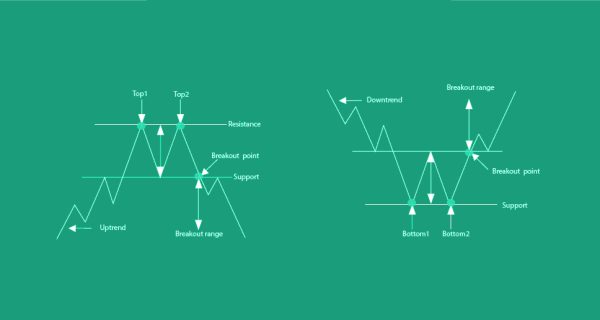

Unlocking the Power of Chart Formations in Technical Analysis: Beyond technical indicators and Japanese candlestick patterns, chart formations play a pivotal role. Technical analysis is built on the premise that price patterns tend to replicate, providing valuable insights into future price behavior. While the numerous classic chart formations may initially appear overwhelming, familiarity comes with practice. Often, the names of these formations aptly describe their appearance on charts. Take, for example, the easily recognizable double top and double bottom patterns, which resemble twin peaks and troughs in price action.

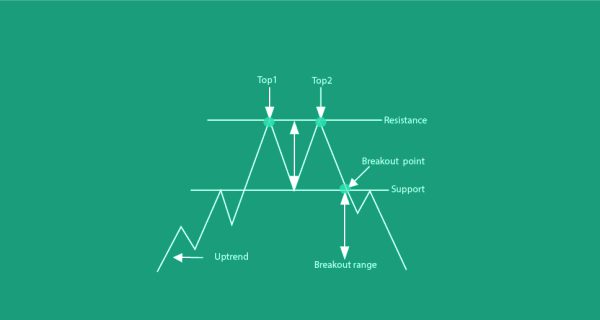

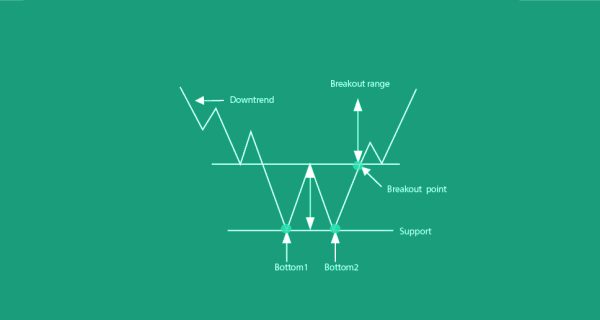

Double top and double bottom

These serve as reversal indicators, indicating the potential start of a fresh trend when the neckline is breached. In such cases, you can place a buy order above the double bottom’s neckline or a sell order below the double top’s neckline.

Double top neckline, entry and resulting selloff

Sketching necklines requires practice, but a useful tip is to draw a horizontal line connecting the price turns between the lows or the highs.

Double bottom neckline, entry and resulting sellof

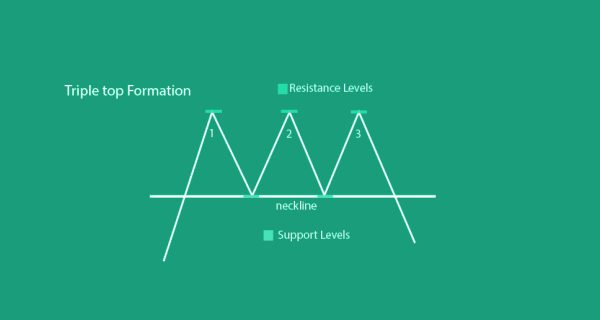

Another form of the double top and double bottom is the triple top and triple bottom, which also serve as reversal indicators. Although they are less common, they can be powerful indicators of a new trend.

Triple top and triple bottom

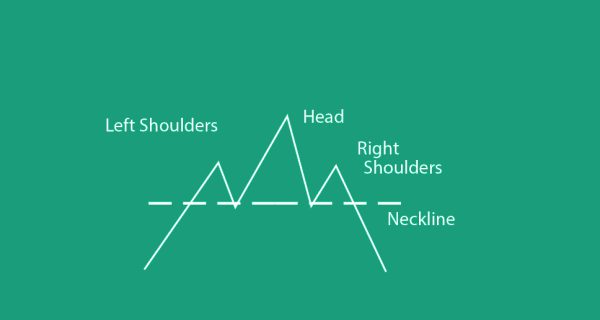

A more intricate reversal pattern is the head and shoulders. If this pattern develops after an uptrend, it can indicate the possibility of a selloff if the price manages to break below the neckline.

Head and shoulders

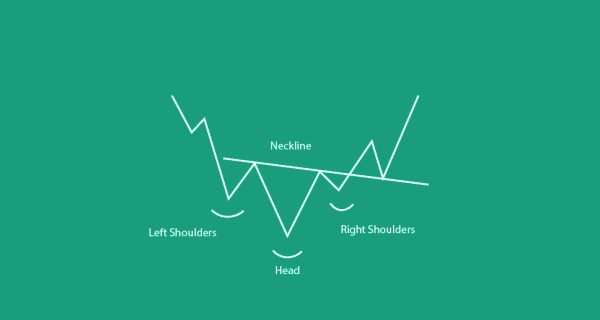

On the contrary, when an inverse head and shoulders pattern emerges at the bottom of a downtrend, it suggests that the price is poised to reverse and potentially enter an uptrend after breaking above the neckline.

Inverse head and shoulders

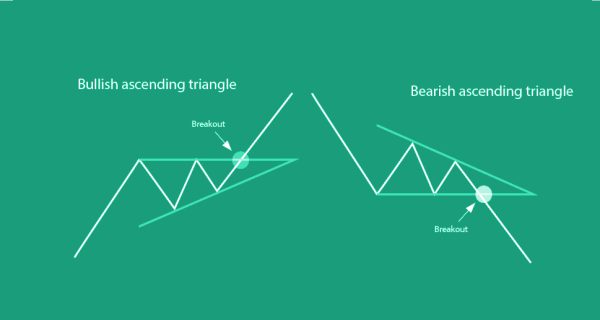

Another category of chart patterns encompasses the triangular formations, which can take the form of descending, ascending, or symmetrical patterns.

Descending triangle, ascending triangle, symmetrical triangle

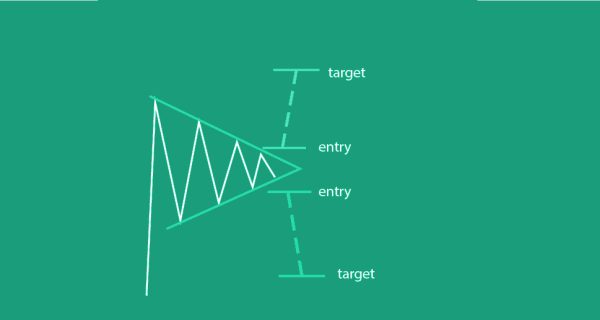

There are no strict rules determining whether these patterns lead to reversals or continuations. When the price consolidates near the apex of the triangle, it often indicates an impending breakout in either direction. Traders aim to capitalize on upward or downward movements by placing buy and sell orders beyond the triangle’s boundaries.

Symmetrical triangle straddle setup

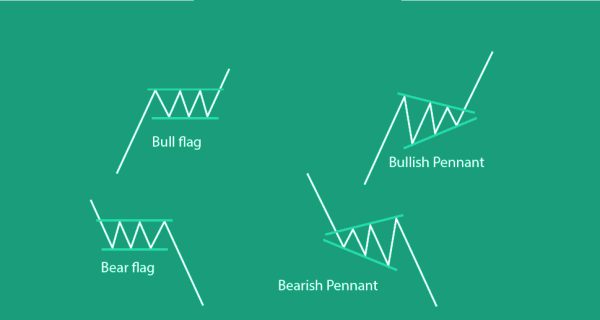

Finally, let’s not forget about another widely recognized category of chart formations known as flags and pennants. These patterns are generally regarded as continuation signals, indicating a brief consolidation period within a flag or pennant before the prevailing trend resumes.

Flag and pennant

We’ll explore additional chart patterns like wedges and cup-and-handle formations in a forthcoming section.

Comment(01)