Fibonacci Tools and Trend Lines

Enhancing Your Trading with Fibonacci Tools and Trend Lines

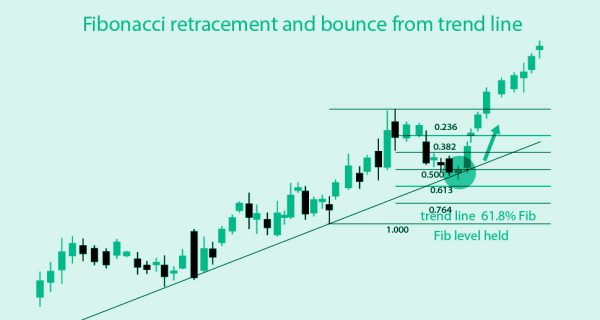

As explored in the preceding sections, Fibonacci retracement proves valuable in trending market conditions, making it beneficial to incorporate it with the use of trend lines.

It is essential to master the art of drawing trend lines correctly for this approach to work effectively. The general guideline is to use a trend line that has been tested and confirmed at least three times. This strategy is more reliable, particularly on longer-term timeframes.

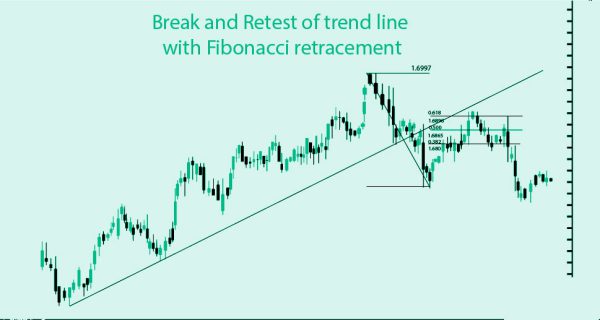

As is the case with other forms of support or resistance paired with Fibonacci retracement, it’s crucial to acknowledge the potential of this method failing. Such a situation could indicate a shift in market sentiment or a change in the prevailing trend, potentially heralding the onset of a reversal.

In such circumstances, traders who remain adaptable and swift to adjust their biases can utilize Fibonacci levels in the direction of the anticipated reversal, patiently waiting for a potential retest of the breached trend line.

Fibonacci extension levels are also effective in establishing profit targets. Nevertheless, some traders prefer closing their trades or executing partial exits at the most recent swing low or high. Typically, in a downtrend, price tends to discover support at the most recent swing low, while in an uptrend, the most recent swing high commonly acts as resistance.

However, in robust trends, price often forges new highs or lows. Once it’s clear which Fibonacci retracement level prompted a rebound, it becomes easier to pinpoint the extension levels that can serve as potential exit points.

The selection of profit levels may differ depending on a trader’s level of aggressiveness and the desired reward-to-risk ratio. Generally, trades that offer a risk-to-reward ratio of at least 1:1 represent a sound trading opportunity.

If scaling into positions is the chosen method for entering trades, scaling out is an option for exiting them. As previously mentioned, traders can book profits or partially close a position when price tests the prior swing high or low. The second or third profit level might be set at the subsequent Fibonacci extension levels to maximize gains, particularly if price forms new highs or lows.

One approach is to close half of the trade position at the prior high or low and then adjust the stop-loss to the entry level in the remaining open position to safeguard recent profits. This method allows traders to transform the open position into a risk-free trade, reducing exposure, especially when high-impact economic events are pending release, or when they cannot actively monitor their trades.